Tax rate

The Tax rate represents any form of tax or levy e.g. VAT, that should be included in the Rate Component amount.

In order to set up, edit or delete rate types, navigate through ResRequest to the Tax rate screen: Admin > Setup > Code tables > Financials > Tax rate.

Creating a Tax rate

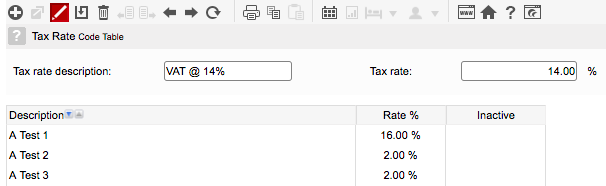

Enter the Tax rate details in the fields at the top and select the Save icon from the toolbar to save it. It will then appear in the list below.

| Field | Description | Notes |

|---|---|---|

| Description | The name of the Tax rate. | This is displayed on reservations documents and reports. Common examples are; VAT, Catering levy, Service charge. |

| Rate % | The tax % that is included in the rate amount. | Note that rate amounts in ResRequest are always inclusive of taxes. |

Edit a Tax rate

All new applications of this Tax rate will use the edited rate. All existing bookings already using this Tax rate will apply the old settings but if you select the Regenerating folios or Regenerating itinerary button on the booking, the new / edited tax rate will apply.

Delete a Tax rate

If the Tax rate has not been used in rates applied on bookings, then it will be deleted permanently. If the Tax rate has been used, it will still appear in the list but will be marked as inactive. This means it will continue to apply to rates where it has already been used but will no longer be available for new rate setups.

Keep up to date with us

Menu

Visit our website

ResRequest Modules

- Business Intelligence

- Central Reservations

- Channel Management

- Customer Relationship Management

- Developer

- Email Series 2022

- Email Series 2023

- Financial Management

- Marketing tools

- Payment Gateways

- Point of sale

- Product

- Professional Services

- Property Management

- ResConnect

- ResInsite

- ResNova

- System Setup

- Technical Alerts

- Technical Tips

- Telephone Management

- Webinars Index